A few months ago we inquired our audience, family, friends and connected people about their knowledge and interest in relation to 3D printing.

The number of participants amounted to 69. We realize that it did not reach many people thus the sample might not be very representative. Yet, it is still informative within its limitations.

We would like to thank everyone who participated!

Next, we share with you the main results of this questionnaire.

Familiarity and general interest

Age and location of the interested participants

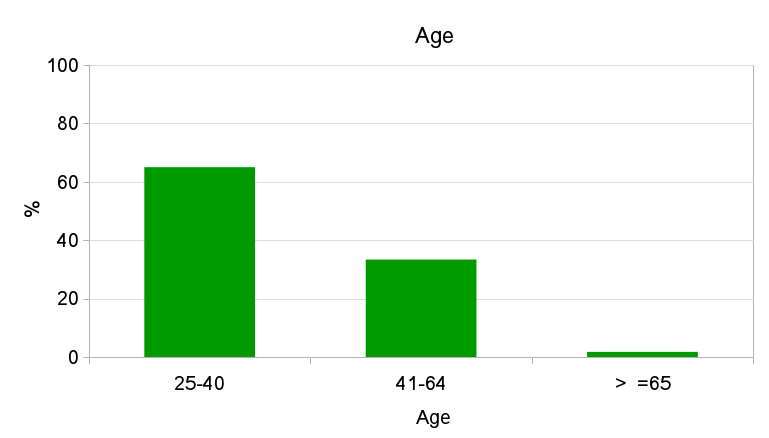

All participants were 25 years old, or older. (Fig. 3)

Regarding participants’ location, Portugal was (by far) the country interested in 3D printing (73.6%) 😉 A few answers were also collected from participants from The Netherlands (5.7%), USA (5.7%), Switzerland (1.9%), Germany (1.9%), Turkey (1.9%), Spain (1.9%), Mexico (1.9%), American Samoa (1.9%), Anguilla (1.9%) and Netherlands Antilles (1.9%).

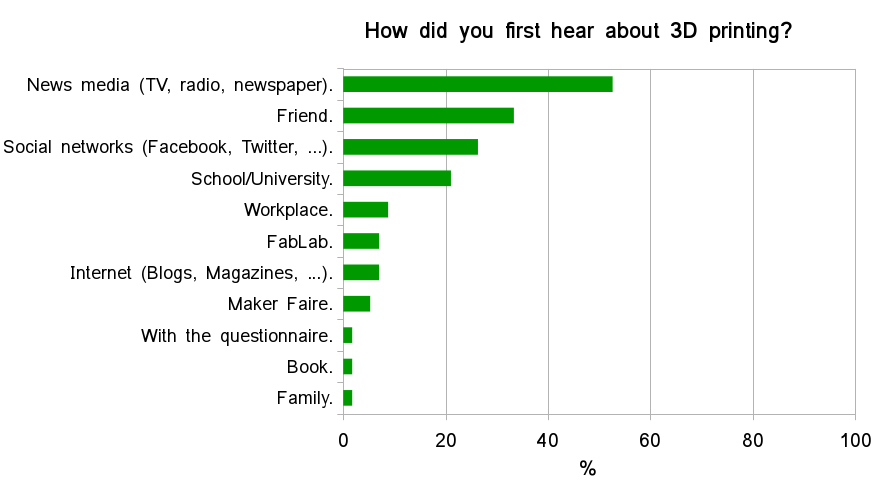

Time and place of first contact

Furthermore, we asked ‘Do you own a 3D printer?”, the majority of participants answered ‘No’ (84.2%), against the 15.8% that answered ‘Yes’.

Next the no‘s and yes‘s were processed separately. Let’s look at the no‘s first.

3D printing interests

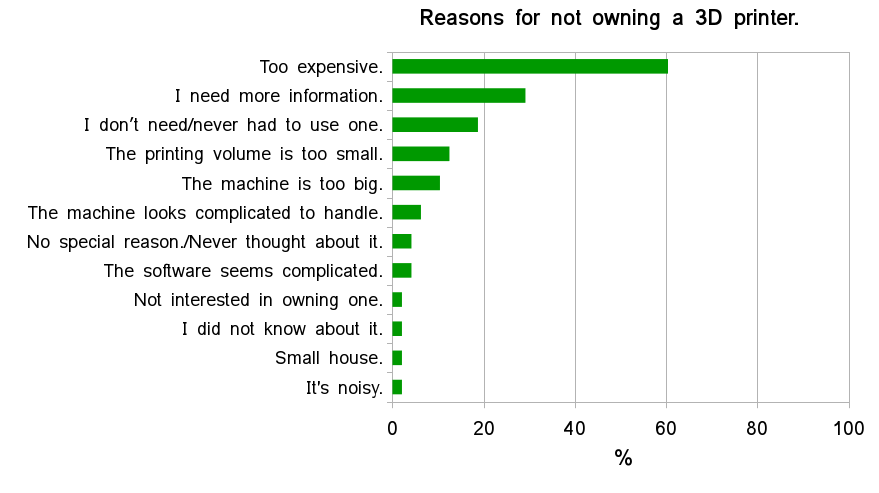

We asked the participants to specify why don’t they have a 3D printer, given that they are interested. Price and lack of information appear as main reasons. Participants also mention not having a special reason, or that they have never strongly considered it yet. Having a small house was also mentioned, which is somewhat connected with considering the machine too big. (Fig. 6)

Next, we wanted to know the uses participants would give to a printer, and what do they value more in a 3D printer machine. Top 5 uses comprise ‘To make toys or instruments’, ‘Prototyping’, ‘Designing and printing tools’, ‘To create/print customized household items’, and ‘To make a business selling my own creations’. (Fig. 7)

Fig. 7 – Uses that participants consider they would give to a printer, if they had one.

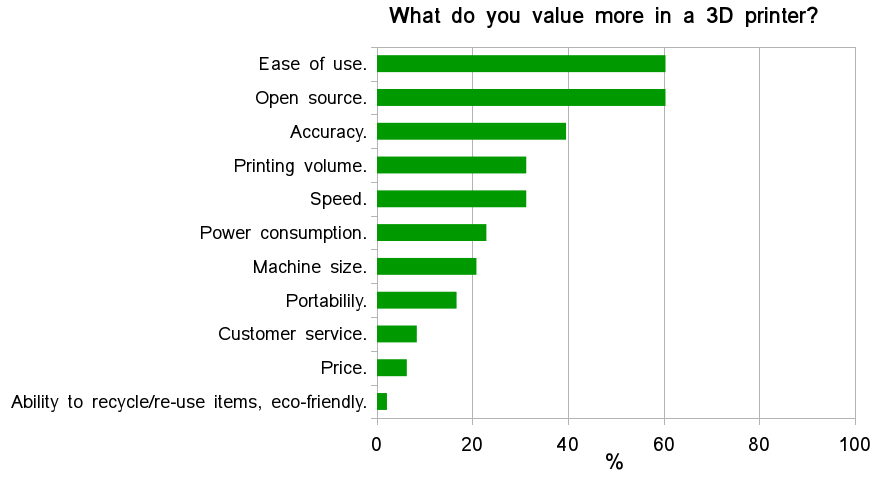

We further inquire what do participants find to be valuable in a 3D printer. ‘Ease of use.’ (60.4%) and ‘Open source’ (60.4%) appear before physical characteristics closely related with printing quality and capabilities, such as ‘Accuracy’, ‘Printing volume’ or ‘Speed’. Interestingly, only 6.3% of participants refer to ‘Price’; however 22.9% mentioned ‘Power consumption” as a valuable characteristic, showing that there is a concern with the costs associated with owing a 3D printer machine. It was also mentioned “The ability to recycle, re-use items, eco-friendly.”. (Fig. 8)

Next, we proceed with the answers from participants that do own a 3D printer.

3D printer satisfaction

There are a few people (15.8%) that have 3D printers. We asked them a few questions about their machine.

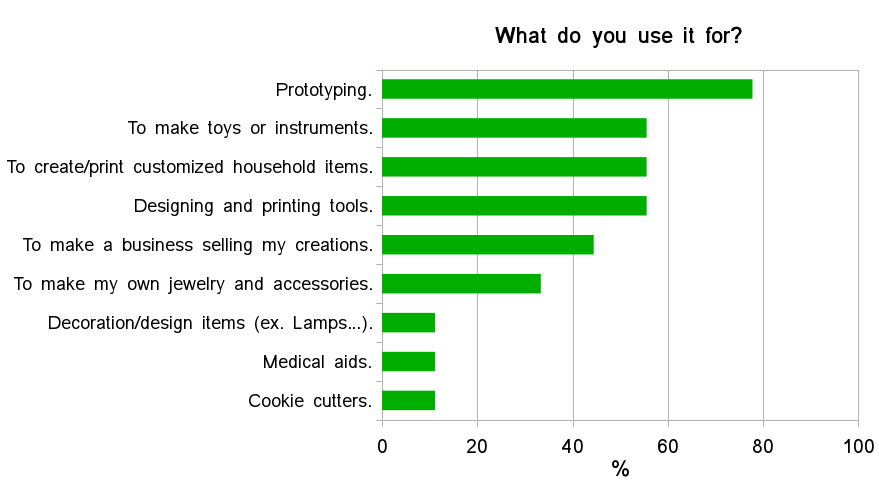

First, we asked what uses are given to the machine. Top 5 uses comprise ‘Prototyping’, ‘To make toys or instruments’, ‘To create/print customized household items’, ‘Designing and printing tools’, and ‘To make a business selling my own creations’. 33.3% of the participants also mentioned that they make their own jewelery and accessories. (Fig. 9)

Fig. 9 -3D printer uses.

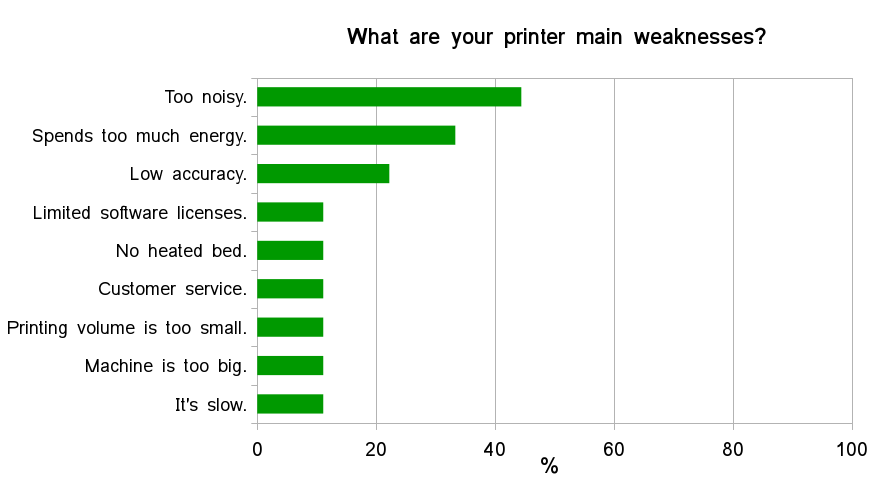

Secondly, we inquired about the printer main weaknesses and strengths. Main weaknesses ( > 20% answers) refer to noise, energy spending, and accuracy. (Fig. 10)

Fig. 10 – 3D printer machine main weaknesses.

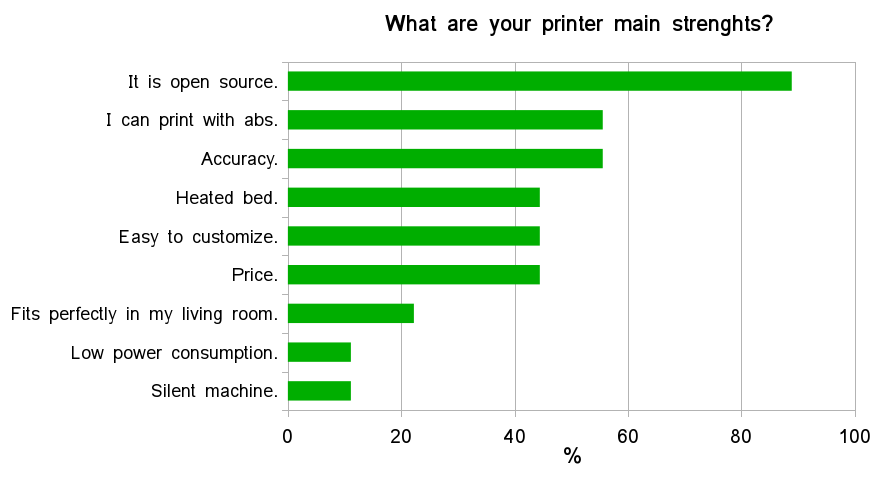

The majority of participants refer that being open source (88.9%), the ability to print with ABS (55.6%) and accuracy (55.6%) constitute main strengths. These were followed by 44.4% of answers referring to having heated bed, being easy to customize and price as main strengths (Fig. 11)

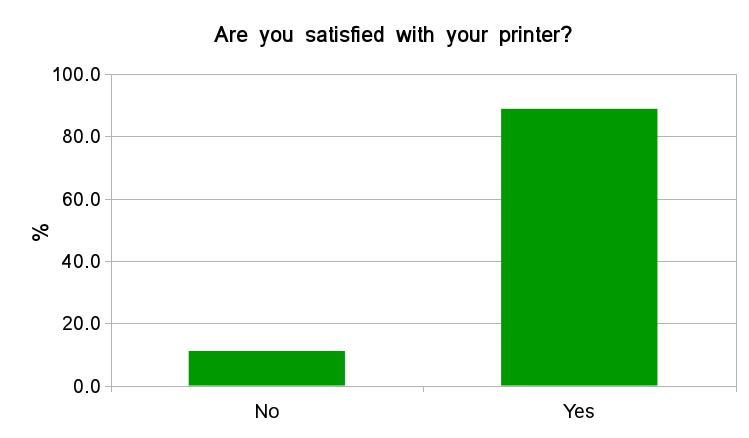

Considering all weaknesses and strengths of the owned machine, 87.5% of participants are satisfied with their 3D printer. (Fig. 12)

Fig. 12 – Satisfaction with the 3D printer.

3D printer buyer interests and profile

Finally, we asked participants about their purchase intentions for a 3D printer, within the next 6-12 months. Only 16.7% of the participants that do not own a printer do consider buying a machine. However, 55.6% of the participants that own a printer, do consider buying another machine in a near future.

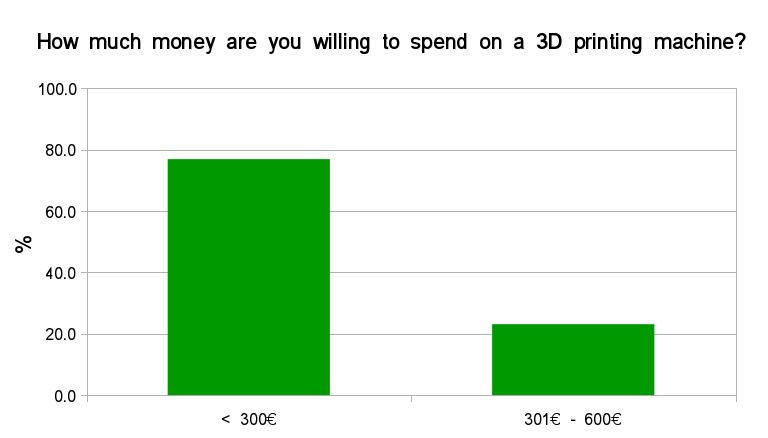

76.9% of the participants that are currently considering buying a 3D printer are not willing to spend more than 300€. (Fig. 13)

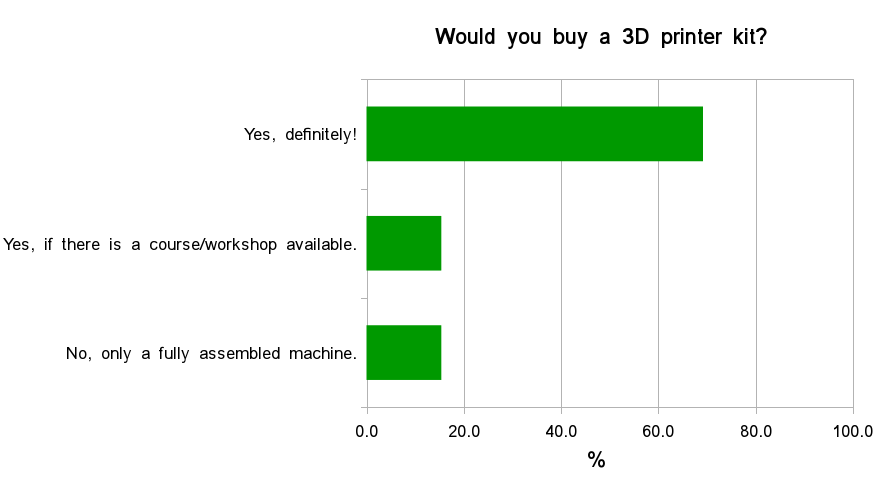

Almost 70% refer that they would buy a 3D kit. 15.4% refer willingness to buy a kit, given the existence of a support course or workshop. (Fig. 14)

Fig. 14 – Willingness to buy a 3D printer kit.

Lastly, participants were asked about their preferential shopping style or location. Although there is a slight preference for buying in a physical store (15.4%), when comparing with buying online (7.7%), the vast majority refer having no preference between these two shopping modalities modalities (76.9). (Fig. 15)

Conclusions

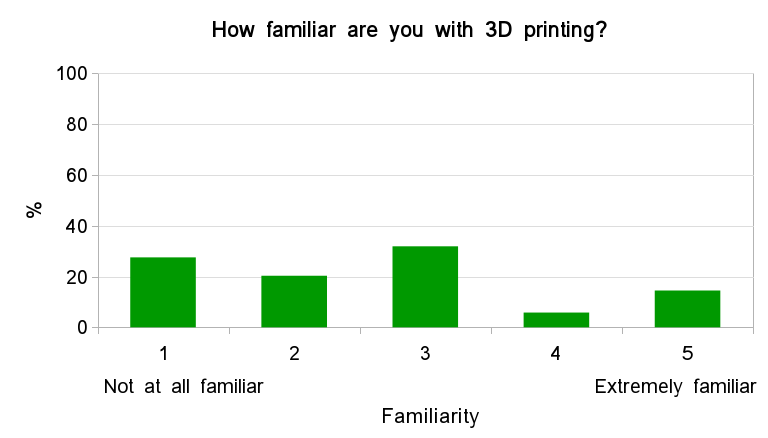

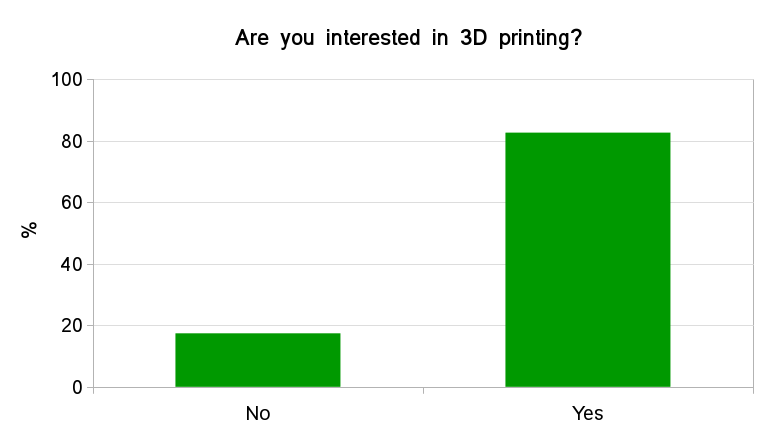

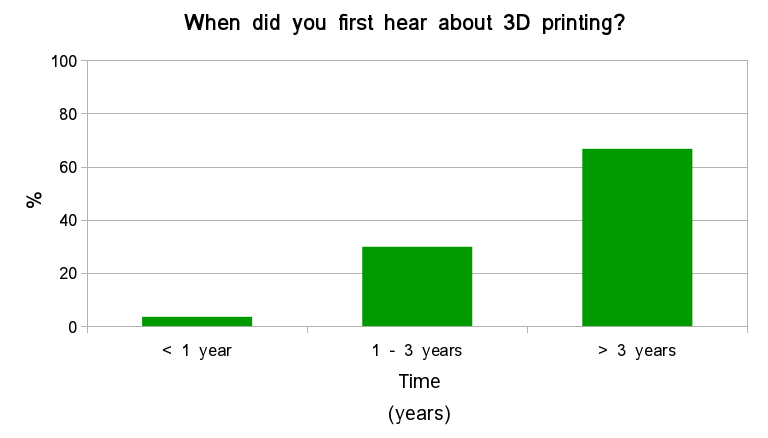

In general, most people are interested in 3D printing, which is likely related to the increased appearance in the media, which was the main mean though which people got their first contact with 3D printing. There is a wide spread general interest, however familiarity with 3D printing is not high. The majority of participants did answer having medium to low or no familiarity with 3D printing. Thus, considering the stated interest, the main contact locations, and that over 95% of participants heard about 3D printing for over a year, this suggests that there the available information is somewhat superficial, and/or the direct contact with 3D printers is still scarce. In fact, ‘I need more information’ reached 2nd place in the list of main reasons appointed for not having a 3D printer.

We find somewhat interesting the convergence of answers when mentioning the uses that participants would give or actually give to a printer. This suggests that those constitute general interests of the population that can be associated to 3D printing.

Being open source is on of the most valuable assets people consider in a 3D printer. For no-owners of 3D printers ease of use is also important, which is not so surprising since possibly there is no previous direct contact with a 3D printer. For current owners the possibility of printing with other materials as abs (related with having a heated bed) is also stated as a main strength. Accuracy comes as the first physical characteristic that is directly related with printing quality, that is mentioned as being valuable or a strength.

We can also infer that noise and energy consumption are a concern for 3D printer customers, an alert to customers considering buying a machine. Additionally, comfort and running costs should be taken into consideration.

Regarding buyers profile, it is perhaps not surprising that most people are highly open to buying online and to cheaper machines. We are, however, somewhat surprised with the high willingness to buy a kit.

As we have mentioned before, the number of participants amounted to 69, thus the sample might not be very representative. Yet, we think that it is still informative within its limitations.

Although there are still many unanswered questions at the moment, we hope that this results may have some value to you.

Be well, and… have fun!

opentronix